This post was guest authored by Madeleine Johnsson

Since the start of the COVID-19 pandemic, the nation’s 61 billionaire-landlords saw their collective net worth of $241 billion increase by 10 percent at a time when countless American families, particularly Black and Brown ones, face acute housing insecurity. Despite a national moratorium on evictions imposed in September 2020, little seemed to stop America’s greediest corporate landlords from driving renters to the brink of homelessness.

Among the most prominent landlord-billionaires are private equity moguls, according to a new report from Bargaining for the Common Good, the Institute for Policy Studies, and Americans for Financial Reform Education Fund. As one of Wall Street’s most lucrative industries, the private equity playbook is akin to a casino where the house always wins.

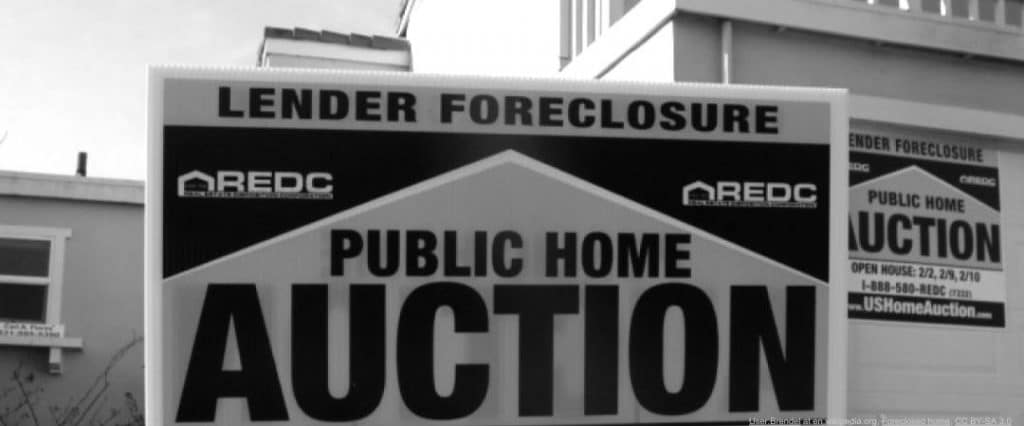

Private equity firms rely on debt to finance their acquisitions, and they rolled up housing empires after the 2008 mortgage finance meltdown. In other sectors, private equity firms sold assets, paid themselves dividends, and laid off workers. Their empires in residential real estate are only different in the sense that it is renters who are squeezed. Private equity landlords used fees, rent hikes, and delayed maintenance to squeeze money from struggling renters in the housing market.

Private equity giant Apollo Global Management earned its housing fortune by selling thousands of rental homes through a predatory arrangement called “contract-for-deed.” Like a casino, the “rent-to-own” scheme offered low-income aspiring homeowners a glimpse at the American dream, but without divulging how the odds were in Apollo’s favor. Tenants could rent a property long enough to become the homeowner if they shelled out for thousands of dollars to renovate uninhabitable properties that violated building codes. If they fell behind on rent, tenants could lose their newly-repaired homes to Apollo.

From March to September 2020, Apollo extracted $1 billion in total revenue with an extra $6 billion cash on hand to scoop up future homes at a moment’s notice. In that same period, Apollo’s co-founders and billionaire landlords Leon Black, Josh Harris, and Marc Rowan increased their net worth to a combined $17.6 billion.

Behind private equity’s housing scheme is a history of preying on renters that spend a high percentage of their income to keep a roof over their heads. This way, corporate landlords have the upper hand on tenants without the time, money, or legal resources to fight eviction notices and unfair practices.

After FrontYard Residential had evicted at least 536 families since the beginning of the pandemic, two private equity firms Ares Management and Pretium Partners, gobbled it up. Ares Co-Founder Antony Ressler did even better; his fortune surged by 37 percent during the pandemic, a $1.6 billion uptick to his current net worth of $4.3 billion.

As some of the richest men on Wall Street, private equity landlord billionaires showed no remorse when going after people’s homes during an unprecedented pandemic. These modern-day robber barons claim bragging rights on economic recessions and housing foreclosures as profit opportunities.

Private equity billionaire landlord and Cerberus Co-CEO Stephen Feinburg declared that rental homes were a “vibrant and durable asset class in 2018” right before Cerberus’ real estate branch FirstKey Homes carried out 222 evictions in 328 rental homes in the Atlanta suburbs between May 2018 to February 2020. Feinburg has a current net wealth of $1.5 billion.

The only homes that matter to private equity billionaire landlords are their own. In 2007, Stephen Schwarzman, the CEO of the world’s largest private equity behemoth, Blackstone, threw a $3 million birthday bash for his 60th complete with a 50-foot silk screen model of his apartment. That same year, Blackstone’s housing subsidiary Invitation Homes unleashed a massive buyout of thousands of foreclosed single-family homes across the U.S. that exacerbated the housing affordability crisis, with a disproportionate impact on communities of color. To this day, the loss of Black and brown homeownership wealth hasn’t fully recovered. Now, the pandemic has left households of color twice as likely to fall behind on rent than white households.

With ten million Americans behind on rent as of January 31, 2021, the moratorium, imposed by the Centers for Disease Control, is set to expire on March 31, 2021. The country needs urgent solutions to avoid a tsunami of evictions and foreclosures comparable to the Great Recession in 2008. In the immediate term, corporate landlords must halt evictions, stop aggressive tactics, erase the backlog of rental payments, and establish a fund to reinvest the profits reaped over the pandemic into renter households.

To address wealth and income inequality, policymakers can pass fiscal policy measures that are redistributive, such as the Ultra-Millionaire Wealth Tax, and pre-distributive, such as the Stop Wall Street Looting Act, which would eliminate tax loopholes for private equity executives and reform an industry that channels wealth upwards to the already rich. To rebuild the housing system in the country, new housing policies must be centered on families of color mistreated by predominantly wealthy, white corporate landlords. That, rather than yet another chance for billionaires to profit, would be a necessary, but not sufficient, start to fighting an unjust housing system.

Leave a Reply