“Carried Interest” Loophole

Perhaps the most extreme example of Wall Street privilege is the tax loophole that allows private equity and hedge fund managers to mis-classify their salaries as investment income, and pay the much lower capital gains tax rate – instead of paying income tax like the rest of us.

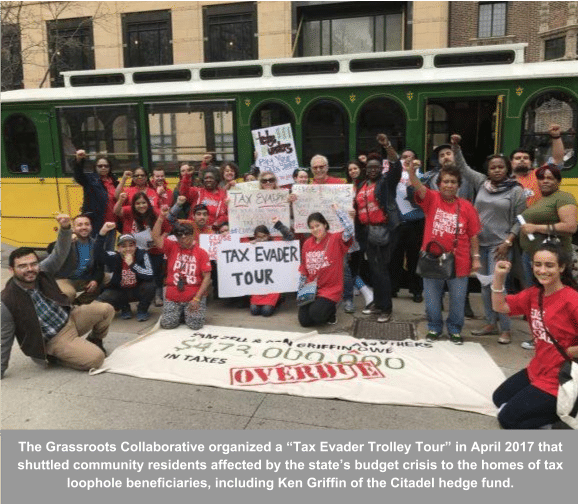

With many private fund managers earning tens of millions of dollars (and in some cases a billion dollars) annually, their tax rate for ordinary income is typically the top marginal rate of 37%. Allowing these fund managers to instead pay the long-term capital gains tax rate of 20% amounts to handing a small number of extraordinarily wealthy people a substantial tax subsidy. As a result, wealthy Wall Street fund managers pay a lower tax rate than millions of our country’s teachers, firefighters, and nurses. This allows financial executives to avoid paying their fair share into a tax system that pays for the roads, schools, and hospitals we all depend on to raise a family or to run a business. Public support for closing the carried interest loophole is broad, deep, and cuts across parties. But intense Wall Street lobbying managed to protect the loophole in negotiations over the tax bill in 2017.

Bills

Carried Interest Fairness Act of 2019 (H.R.1735/S.781)

This legislation introduced in the 115th Congress closes the carried interest loophole which currently allows billionaire Wall Street money managers to pay lower tax rates than nurses or construction workers.

![]() Factsheet: Close the Carried Interest Loophole

Factsheet: Close the Carried Interest Loophole

Learn More

- “US states move to close carried interest loophole: Private equity group Blackstone says it faces higher tax bills if proposals become law,” by Mark Vandevelde and Lindsay Fortado, Financial Times, May 21, 2018.

- “Memo to Congress: On tax fairness, follow the lead of states and cities,” by Leo Hindery, Jr. and Tal J. Zlotnitsky, The Hill, April 11, 2018.

- “DC Joins Seven States with Campaigns to Close the Carried Interest Loophole,” by Sarah Anderson, Inequality.org, March 26, 2018.

- Reports on Carried Interest by State, including Illinois, New York, Maryland, Connecticut, DC/MD/VA, California, by Hedge Clippers.

- “Donald Trump’s New Tax Loophole is Ripping Off His Supporters”, by Take on Wall Street, Other98, 2017.

- “State Action on Hedge Fund Loophole”, by Sarah Anderson, Inequality.org, May 25, 2017.