Private Equity

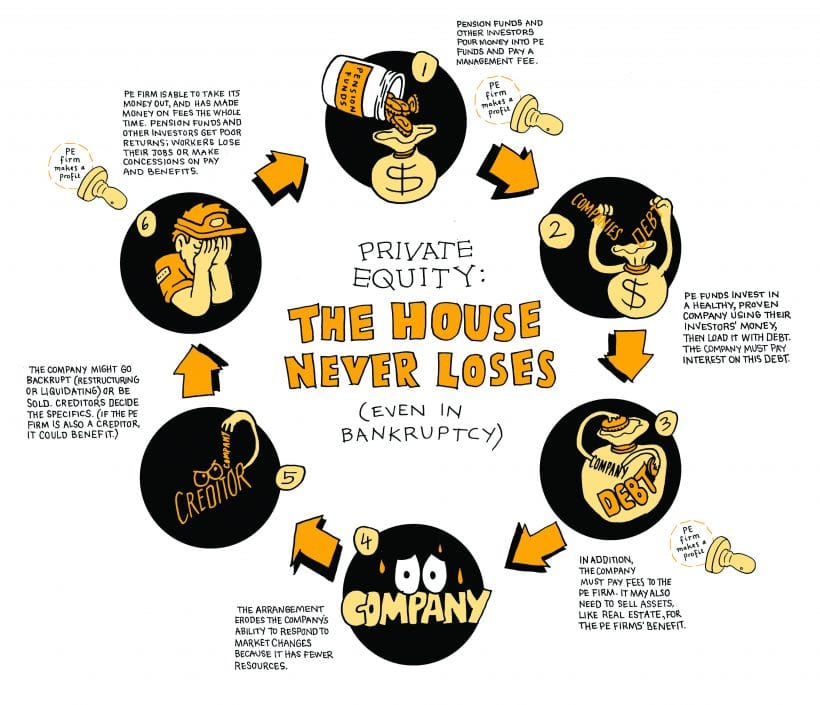

The private equity industry is massive, hugely influential, and playing a role in more and more aspects of life in the US and around the world. The industry manages $4 trillion in assets and owns companies that employ more than 11 million American workers, plus millions more in other countries. Much like the corporate raiders of the 1980s, these private Wall Street firms are increasingly buying control over businesses, housing, education, consumer lending, energy, infrastructure and more, making a small class of money managers extremely rich.

Their debt-fueled model is not unlike payday lending or loan sharks, only for companies rather than individuals. Private equity’s aggressive use of debt and other methods drain value from companies. Employees, creditors, and other stakeholders bear the consequences if the company fails, while the private equity owners themselves most often still walk away with gains. As a result, private equity’s involvement in a company has a tendency to kill jobs and suck wealth from workers, tenants and communities. As one expert quips, private equity is perhaps the single most efficient wealth transfer from taxpayers, workers, and retirees to the .01%.

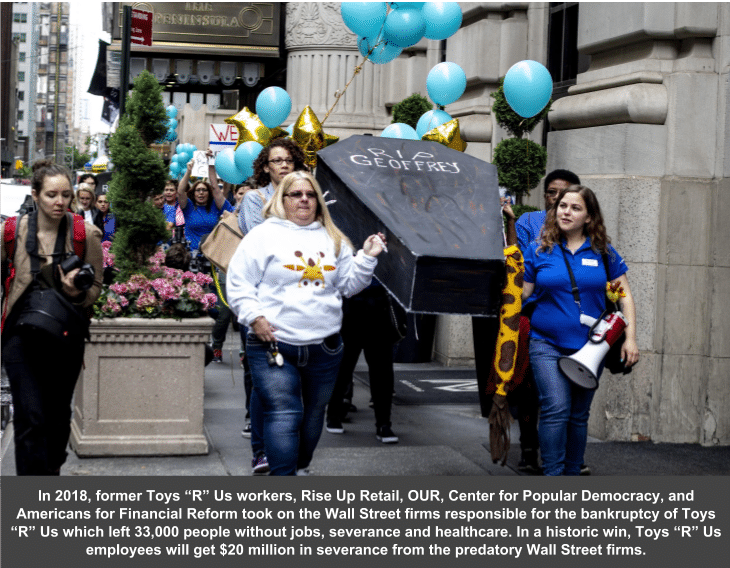

One recent example is how the firms Bain Capital, KKR, and Vornado killed the toy company Toys R Us and laid off 33,000 workers. Our partners at Rise Up Retail, OUR, and the Center for Popular Democracy decided to fight back, and Toys R Us workers organized to secure a $20 million severance fund from Bain and KKR in November 2018.

Bills

The Stop Wall Street Looting Act of 2019 (S. 2155/H.R. 3848)

The bill addresses the predatory elements of the private equity business model that harm workers, investors, and communities. Specifically, it would make private equity executives legally liable for the damage they cause; stop looting that enriches PE executives at the expense of workers, communities, and businesses; close tax loopholes and change rules that encourage predatory financial activities; protect workers if employers go bankrupt; and require PE firms to be fair and transparent to investors in disclosing costs and returns.

![]() Factsheet: Stop Wall Street Looting Act of 2019

Factsheet: Stop Wall Street Looting Act of 2019

Learn More

- “When Wall Street Took Over This Nursing Company, Profits Grew and Patients Suffered: As investors assemble pediatric care giant, safety lapses mount.” by Sabrina Willmer, Bloomberg, October 22, 2019.

- “Everything is Private Equity Now: Spurred by cheap loans and investors desperate to boost returns, buyout firms roam every corner of the corporate world.” Full Issue of Bloomberg Businessweek, October 3, 2019.

- “Who Advocates for Surprise Medical Billing? Private Equity Hides behind Physicians’ White Coats,” by Yves Smith, Naked Capitalism, September 26, 2019.

- “A Top Financier of Trump and McConnell is a Driving Force behind Amazon Deforestation,” by Ryan Grim, The Intercept, August 27, 2019.

- “Wall Street Greed’s Latest Target: Fertility Clinics”, by Kyra Sadovi, Take on Wall Street blog, August 7, 2019.

- “Private Equity’s Role in Retail has Killed 1.3 Million Jobs, Study Says: Women and People of Color have been Disproportionately Affected by Closures at Debt-saddled Stores”, by Abha Bhattarai, The Washington Post, July 24, 2019.

- “Pirate Equity: How Wall Street Firms are Pillaging American Retail”, by United for Respect, Private Equity Stakeholder Project, Hedgeclippers, Center for Popular Democracy, Americans for Financial Reform, and Strong Economy for All Coalition, July 24, 2019.

- “Julian Castro and the Predatism of Private Equity”, by Helaine Olen, The Washington Post, July 15, 2019.

- “At Netroots Nation, a Worker’s Voice Spoke Volumes: Sarah Woodhams, a laid-off Toys “R” Us employee, highlighted the schemes of private equity, to a somewhat baffled Julián Castro.” by David Dayen, The American Prospect, July 15, 2019.

- “Wall Street Private Equity Landlords Snapping Up Apartment Buildings”, by Americans for Financial Reform, New York Communities for Change, and the Private Equity Stakeholder Project, May 1, 2019.

- “Eviction filings and code complaints: What happened when a private equity firm became one city’s biggest homeowner”, by Todd Frankel and Dan Keating, Washington Post, December 25, 2018.

- “This Invisible Industry Might Be the Worst Thing About Late Capitalism”, by David Dayen, VICE, November 28, 2018.

- “Overdoses, bedsores, broken bones: What happened when a private-equity firm sought to care for society’s most vulnerable”, by Peter Whoriskey and Dan Kean, Washington Post, November 25, 2018.

- “Fact Sheet: Private equity-owned firms dominate prison and detention services,” by PE Stakeholder Project, September 17, 2018.

- “AFR Policy Brief: The Toys R’ Us Bankruptcy And Private Equity Predation,” by Americans for Financial Reform Education Fund, May 10, 2018.

- “Congressional Briefing on Toys “R” Us Remarks of Eileen Appelbaum Co-Director at the Center for Economic and Policy Research,” May 9, 2018.

- “Private Equity’s Failing Grade in the For-Profit College Industry”, by Americans for Financial Reform (AFR) and Private Equity Stakeholder Project, March 2018.

- “Wall Street Landlords turn American Dream into a Nightmare”, by Alliance of Californians for Community Empowerment (ACCE) Institute, Americans for Financial Reform (AFR), and Public Advocates, January 2018.

- “Payday Lending and the Private Equity Business”, by Americans for Financial Reform (AFR) and Private Equity Stakeholder Project, December 2017.

- “Investors pour money into addiction treatment, but quality questions remain”, by Harris Meyer, Modern Healthcare, November 24, 2018.

- “How Laid-Off Toys R Us Workers Came Together To Fight Wall Street”, Dave Jamieson, Huffpost, November 20, 2018.

- “Retail and private equity: An in-depth look at the risky relationship”, Ben Unglesbee, retail Dive, November 9, 2018.

- “Private-equity money backs an effort to overturn California law intended to help the poor”, by Peter Whoriskey, Washington Post, October 29, 2018.

- “Private Equity Pillage: Grocery Stores and Workers At Risk”, by Rosemary Batt & Eileen Appelbaum, American Prospect, October 26, 2018.

- “How California public employees fund anti-rent control fight unwittingly”, by David Sirota, The Guardian, October 23, 2018.

- “Jobs, Pensions Lost in Sears Bankruptcy, but Hedge Fund King Gets Paid”, by Eileen Appelbaum, Center for Economic and Policy Research, October 15, 2018.

- “Private equity buying banks is not a good mix”, by Financial Times, September 16, 2018.

- “Are some investors placing votes in favor of private equity based on fake news?”, by Preston McSwain, September 5, 2018.

- “When Private Equity Wins and Consumers Lose”, by Julie Segal, Institutional Investor, September 4, 2018.

- “The Next Financial Crisis Lurks Underground: Fueled by debt and years of easy credit, America’s energy boom is on shaky footing.”, by Bethany McLean, New York Times, September 1, 2018.

- “Here Comes the Second Wave of Big Money in the “Buy-to-Rent” Scheme”, by Wolf Richter, naked capitalism, August 24, 2018.

- “Private Equity’s Biggest Mystery Has a Simple Answer: Their shares struggle because of big pay for top executives”, by Stephen Gandel, Bloomberg, July 20, 2018.

- “Congress confronts Bain Capital, KKR over Toys R Us liquidation”, by Adam Lewis, PitchBook, July 6, 2018.

- “State pension funds question KKR on role in Toys R Us demise”, by Bloomberg, Pensions&Investments, June 22, 2018.

- “What Happens when Wall Street becomes your landlord?”, by Negin Owliaei, Inequality.org, January 22, 2018.

- “Private Equity at Work: When Wall Street Manages Main Street,” by Eileen Appelbaum and Rosemary Batt, Russell Sage Publishers, May 2014.